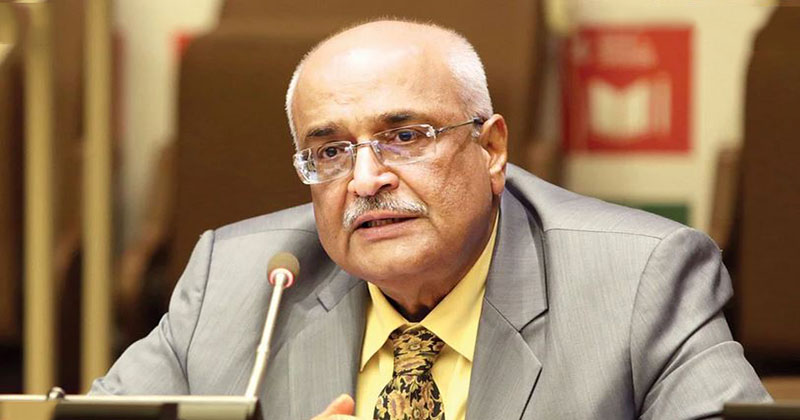

The existing foreign currency crisis in the country has eased to some extent compared to the previous year, Association of Bankers, Bangladesh Limited (ABB) Chairman Selim RF Hussain said on Monday.

"However, the situation is yet to get back to complete normalcy," he said while addressing a press conference on "Bangladesh Banking Sector Outlook 2023" organised by the ABB.

"Most banks are now regular in foreign payments while there could be some problems with only 2/3 banks," the ABB chairman added.

He further noted that the foreign corresponding banks who withdrew the credit limit before are now coming back as they are satisfied with the country's current state.

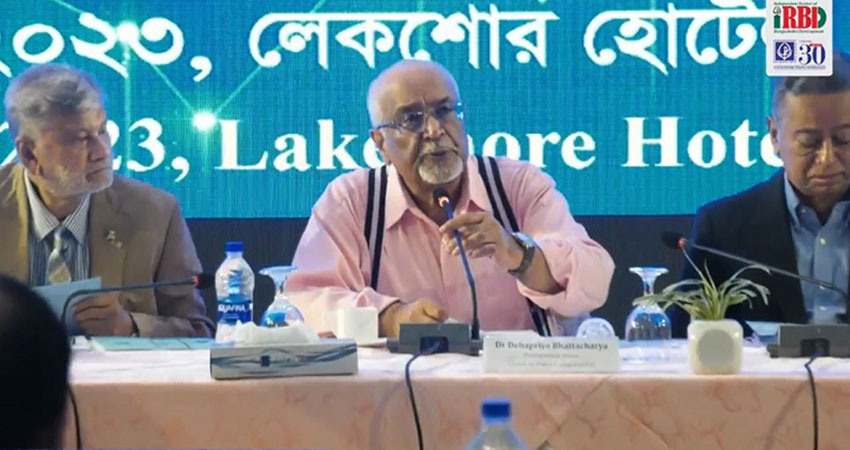

Mashrur Arefin, vice chairman of the ABB said, "Net opening position of dollar holdings of banks turned to positive from the negative trajectory as remittance inflow and deposit is increasing. Besides, the dollar rate gap between the formal and informal markets is narrowing, which means the banking sector is returning to stability.

"The Bangladesh Bank's intervention helped to stabilise the foreign exchange market. The gap between formal and informal market rates has narrowed down to a maximum of Tk1," he added.

According to the ABB vice chairman, the net opening position of dollar holding of banks was negative $600 million last year and now it has reached a $38 million positive.

Besides, the dollar rate for remittance is Tk110.70, including a 2.5% incentive, which on some days the rate is even lower in the informal market.

Stating that the excess liquidity is now at Tk1.35 lakh crore, Mashrur Arefin said, "Although liquidity crisis in the country has not returned to the pre-crisis level, the situation did improve to a large extent."

Highlighting the improved sources of foreign currency, Selim RF Hussain said banks can now open LCs but not for all.

"Previously, banks would open LCs without considering the payment capacity but now they have come out from this trend," he said, adding that banks are now more cautious in this regard.

The ABB chairman further noted that the pricing control of imported goods by Bangladesh Bank helped reduce trade-based money-laundering.