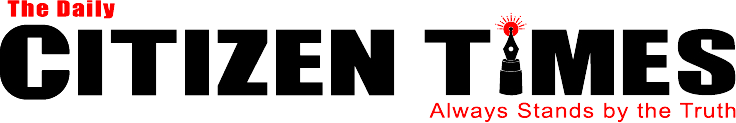

A recent report from the Financial Times claims that the Adani Group, India's largest private coal importer, imported coal at prices significantly higher than market rates, raising suspicion that the group has been inflating fuel costs and forcing consumers and businesses to overpay for electricity.

The investigation, based on customs records since July 2021, claims that the group paid a total of $4.8 billion for coal, well above prevailing market prices. The report further states that three offshore intermediaries in Taiwan, Dubai, and Singapore received a premium, at times more than double the market price.

The Adani Group maintained a studied silence after the latest report fired another broadside against the group's flagship — Adani Enterprises — which has been rattled by several exposés since the US short-seller Hindenburg Research report in January that sparked a massive meltdown in the Adani group's market valuation in February.

The Adani group had been so rattled by reports that the newspaper's journalists had started an exhaustive investigation into coal imports by the group — often rapping on doors, making calls, emailing questionnaires and even shoving written questions under the door of one office in Singapore — that they took the unprecedented step of making a regulatory filing with the bourses to rubbish an upcoming report by the Financial Times.

It had accused the FT of continuing with its relentless campaign to tarnish the image of the Adani group by regurgitating old allegations that it over-invoiced coal imports. It also accused the FT of malicious bias and acting in cahoots with Hungarian-born American investor George Soros and the Soros-funded journalist network called Organised Crime and Corruption Project, which had provided a trove of documents for an earlier report in the paper.

These allegations, the group said, had not stood up to scrutiny before a customs tribunal and the Directorate of Revenue Intelligence (DRI), which had been pursuing the case, had been forced to withdraw an appeal before the Supreme Court early this year.

The Adani group's statement had stoked enormous interest in the Financial Times report. When it came out on Thursday, it was evident that the paper had trawled customs databases in India and Indonesia, matched shipments, scoped sailing schedules and even used the services of a satellite data company to put together an entirely new set of charges.

An official for the Adani group said it was standing by the statement that was issued on Monday night.

"The FT's proposed story is based on the DRI's general alert circular…dated 30 March 2016," the company had said in that statement.

It wasn't. The FT began its investigation on the premise that even though the DRI case had stumbled, there were reasons to believe that the group had not abandoned the practice of over-invoicing coal imports.

Describing Gautam Adani as "Modi's Rockefeller", the paper wrote: "The unresolved nature of the DRI investigation and the apparent continuation of the alleged practices raise fresh questions about the relationship between Adani and the administration of Prime Minister Narendra Modi."

The three middlemen

The group used three middlemen companies to import coal to India: Hi Lingos which ran operations out of a residential address in Taipei, a Dubai-based company called Taurus, and a small Singapore firm named Pan Asia Tradelink which, the paper claimed, was "run by a former employee" of the Adani group.

The paper focused its attention first on 2,000 shipments totalling 73 million tonnes of coal that had been declared as imports by the Adani group between September 2021 and July 2023 — a period long past the earlier DRI investigation.

Of the 73 million tonnes of coal, shipments worth 42 million tonnes were made by the Adani group itself and were declared at an average price of $130 per tonne.

The remaining 31 million tonnes were supplied by the three middlemen, the paper said. The average price declared for the coal supplied by these three firms was $155, a 20 per cent premium worth $800 million.

Hi Lingos, which is owned by Taiwanese businessman Chang Chung-Ling, supplied 12.9 million tonnes of coal in 428 shipments from Australia and Indonesia. The Adanis paid about $2 billion for the coal the firm supplied.

An earlier Financial Times report, published on August 31, had identified Chang as a close associate of Vinod Adani, the elder brother of the Indian tycoon. Chang had been one of the largest shareholders in three Adani group companies between 2013 and 2017, a stake that had been built up by funnelling money through a labyrinth of companies based in several tax havens.

Chang's alleged accomplice was a UAE businessman called Nasser Ali Shaban Ahli who routed funds into the Adani companies through Mid East Ocean Trade, Mauritius, in which Ahli was the beneficial owner; and Gulf Asia Trade & Investment Ltd (BVI) where Ahli was the "controlling person".

The latest report says the second middleman in the coal shipments was Dubai-based Taurus, which is owned by Mohamed Ali Shaban Ahli. The paper said the name sounded similar but it couldn't establish whether Mohamed was Nasser's relative.

Adani paid Taurus $1.8 billion for 11.3 million tonnes of coal supplied since September 2021, according to the Indian records reviewed.

But the most interesting player was Pan Asia Tradelink which "supplied Adani with 6.6 million tonnes of coal for $1.1 billion since September 2021".

"The average price of $169 per tonne was a 30 per cent premium to the price of coal Adani sourced itself," the paper claimed.

Another dataset

The paper pored over another set of data on coal imports relating to an earlier period: between January 2019 and August 2021.

During this period, the paper was able to match shipments out of Indonesia and arrivals in India.

There was a reason why the investigation focused on this period. Customs data was available from both India and Indonesia, enabling the paper to match the shipments. After August 2021, Indonesian records were no longer available.

Out of this datapile, FT chose to focus on "30 representative sailings" totaling 3.1 million tonnes. The paper says that the cost of coal amounted to $139 million in Indonesia. Add to that another $3.1 million in shipping and insurance costs.

The Adani group, however, declared the value of the shipments at $215 million "suggesting that the voyages made $73 million in profits: a 52 per cent profit margin."

The paper went on to say that coal trading is a high-volume competitive business where profit margins usually are in "the low single digits".

Adani Enterprises, the group's oldest and most valuable company, generates the lion's share of its sales and profits from its coal trading division, called Integrated Resources Management. IRM revenues accounted for 72 per cent of the company's total sales in 2023, the paper added.

The most remarkable bit in the FT report is the way it tracked a single shipment to understand how the price of coal was jacked up.

In January 2019, a bulk carrier named the DL Acacia left the Indonesian port of Kaliorang in East Kalimantan carrying 74,820 tonnes of thermal coal meant for a power plant in India.

The paper wrote: "During the voyage, something extraordinary happened: the value of its cargo doubled. In export records the price was $1.9 million plus $42,000 for shipping and insurance. On arrival at India's largest commercial port, Mundra in Gujarat run by Adani, the declared import value was $4.3 million."

Benchmark pricing

The paper was aware that prices of coal vary widely depending on its quality and the calorific value. It says that much of the coal supplied by the middlemen was of high quality based on calorific value, which is the total energy released on combustion.

So, it compared the coal supplied by the middlemen against a benchmark for Indonesian coal sourced from Argus, a data provider.

There were 311 shipments originating from Indonesia where the calorific value had been declared. "All but a few were priced at a premium to what the closest Argus benchmark price," the paper said.

Often, they were much higher than the benchmark. One shipment by Hi Lingos, made in August 2022 with a declared calorific value of 5,004 kilo calories, carried a price tag of $179 per tonne.

"The highest price for the Argus 5000 calorie benchmark in the preceding three months was $145 per tonne," the paper added.

Source : Financial Times